Home Buying 101 for First Time Home Buyers

Buying a home is likely one of the most significant financial investments you'll ever make. For first-time homebuyers, navigating the home-buying process can be both exhilarating and overwhelming. With myriad steps, financial jargon, and crucial decisions to be made, preparation isn't just useful—it

Your home didn't sell, now what?

Listing your home for sale is a big step, and it's understandable to feel disheartened if it doesn’t sell within your desired timeline. However, don’t lose hope. In this blog, we'll outline what you can do next to turn this setback into an opportunity. 1. First, reassess your marketing strategy. An

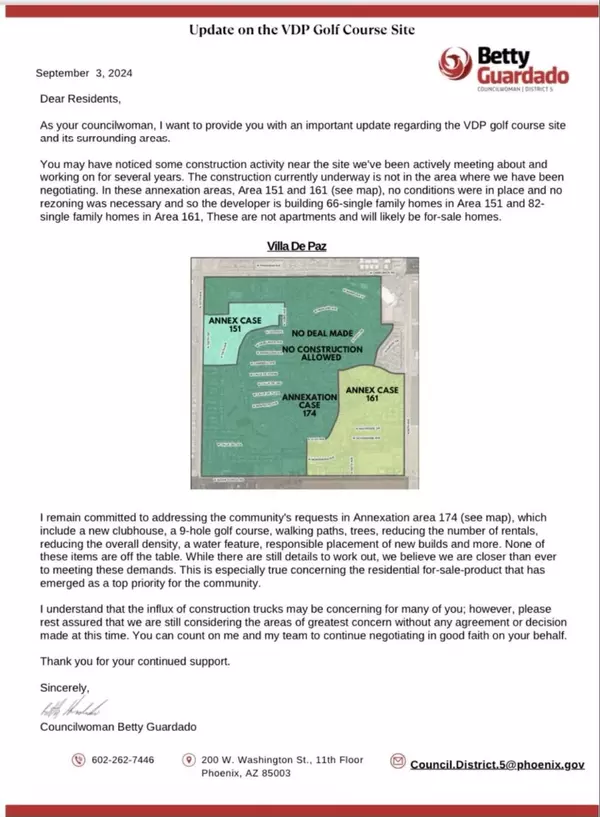

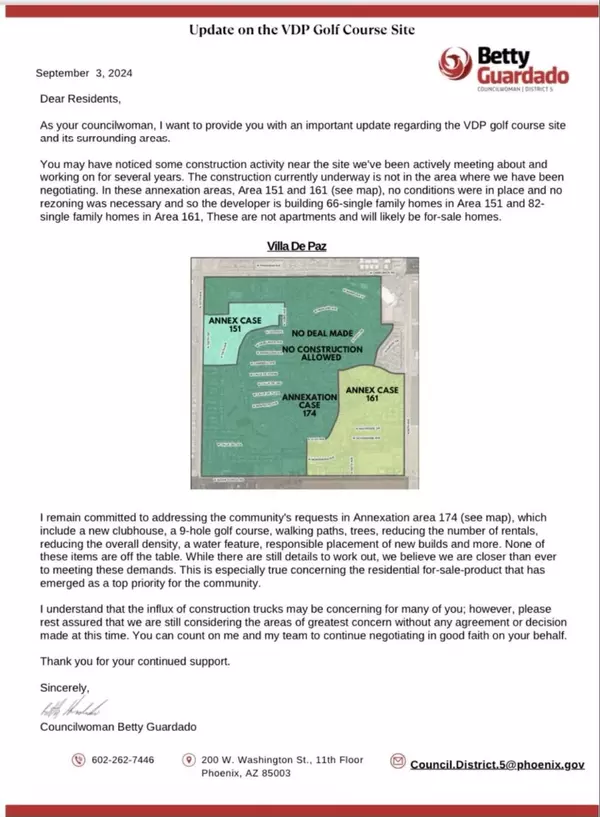

Villa De Paz Golf Course Development Update

As promised, we’re following up on the proposed redevelopment of the former Villa de Paz Golf Course. There have been some significant developments since our last update, and we wanted to keep you informed. A Partial Win for Residents While the initial vision for a mixed-use development with a 9-

Categories

Recent Posts